Vincent Gramoli

School of Computer Science

1, Cleveland St.,

NSW 2006 Sydney

Follow @VincentGramoli

Blockchain Complies With Regulation

03 Jun 2024 - Vincent

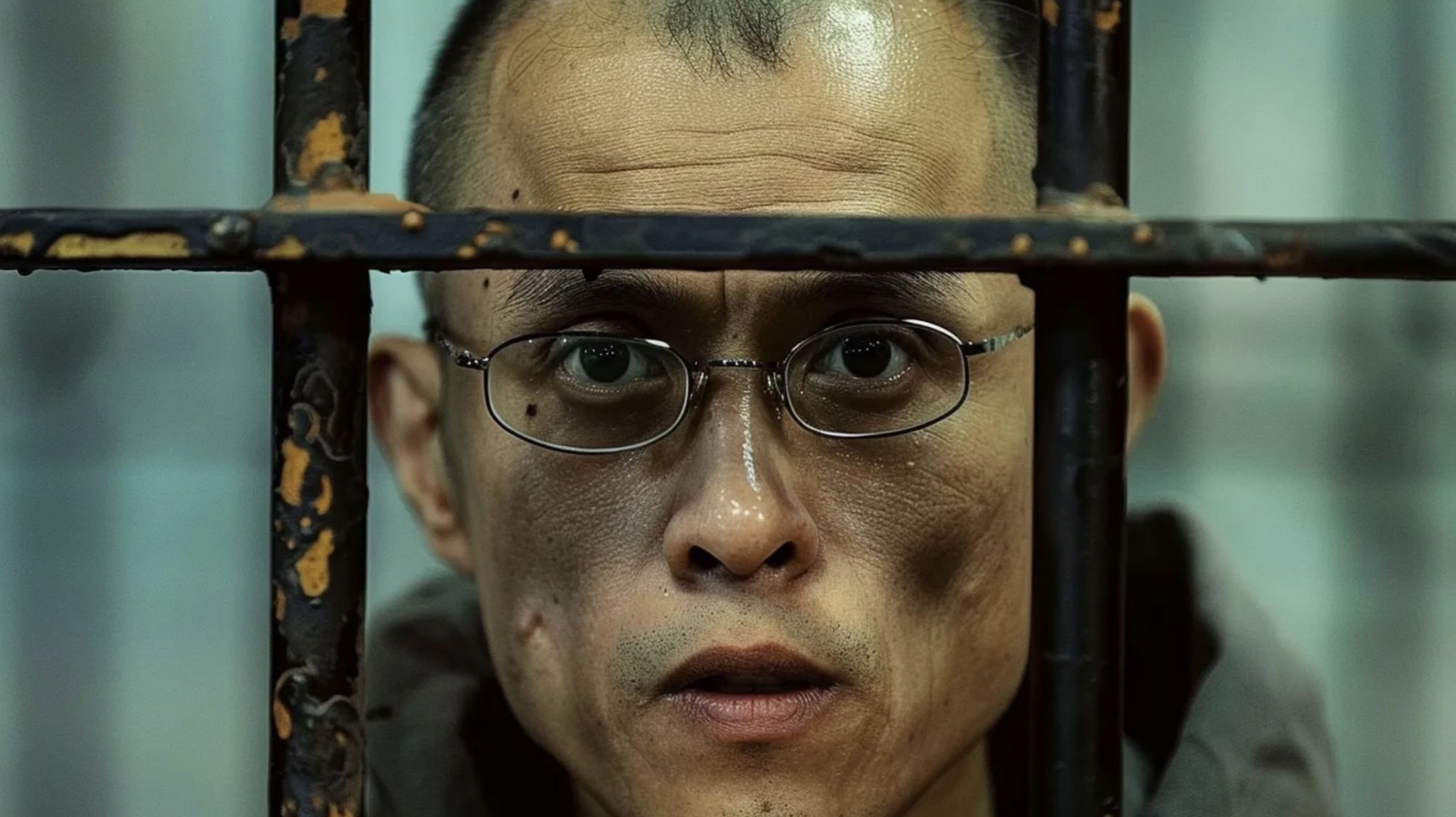

As CZ, the former Binance CEO, is entering jail for having violated anti money laundering laws in the US through the use of blockchain technology, the solution to compliant blockchain has just appeared. For the last 15 years, blockchain has been a refuge for pseudonymous or anonymous users to trade assets without trusting a central financial institution. As regulation is catching up with technology, Redbelly Network has just launched its new open network simply requiring its users to first register with an identity provider.

Within the same year of 2008, came the global financial crisis and Bitcoin. So almost at the same time the trust of individuals in financial institutions was broken, a new technology, called blockchain, was proposed to track ownership of financial assets, initially called cryptocurrencies, without the supervision or control of a financial institution.

Since then, the growth in cryptocurrency payments far exceeded the growth in other payments. The global user base of cryptocurrencies increased by nearly 190 percent between 2018 and 2020 according to Statista.com [1]. Some studies [2] even indicate that in 2021 the ownership in cryptocurrency started exceeding payment giants like American Express.

In 2023, Gary Gensler, Chair of the Security Exchange Commission (SEC) in the US, explained that if an asset is sold as an investment with the expectation of profit based on the efforts of others, it is likely to be considered a security. As a result, a lot of cryptocurrencies have been considered securities and came under SEC regulation. They thus need to be registered with the SEC and offered to institutional investors, which was not the case.

Since last week, blockchain now offers a solution to this need for compliance. The same challenge is common to both complying with anti money laundering laws and offering investment contracts to institutional investors. This challenge consists of identying the users of these services and contracts. Fortunately, Redbelly Network has just launched its second network version last Friday, requiring users to complete a registration with an identity provider. Within few days, hundreds of users have registered to comply with regulation and benefit from a fast blockchain.

Having a solution to tokenise assets that complies with regulation is also reassuring: Real World Assets (RWA) tokenisation is booming with an expected growth of up to 80x between 2023 and 2030 as forecast by KPMG [3]. Between different technologies, users who do not want to go to jail, should probably start by using Redbelly Network, which supports Solidity smart contracts, to tokenise and trade their assets.

[1] https://www.statista.com/statistics/1202503/global-cryptocurrency-user-base/

[2] https://triple-a.io/cryptocurrency-ownership-data/

[3] KPMG - SFA. The Asset Tokenization C-Suite Playbook. Feb 2024.